Davud Rostam-Afschar

Professor, University of Mannheim

Welcome!

I'm an economist mainly interested in research on decisions of households and firms on product and labor markets,

public and macreconomics.

Upcoming talks: ASSA, Österreichische Nationalbank, Uni Hannover, Universität Duisburg-Essen,

Mannheim Research Colloquium on Survey Methods, KOF-Research Seminar Zurich, LUISS Rome

Check out some of my latest work

You can contact me by email:

rostam-afschar(at)uni-mannheim.de (GPG-Key).

-

The Asymmetric Incidence of Business Taxes: Survey Evidence from German Firms

Authors: Richard Winter, Philipp Dörrenberg, Fabian Eble, Davud Rostam-Afschar, Johannes Voget

Conditionally Accepted at AEJ: Economic Policy

-

Followers or Ignorants? Inflation Expectations and Price Setting Behavior of Firms

Co-authors: Philipp Dörrenberg, Fabian Eble, Christopher Karlsson, Benjamin Tödtmann, Johannes Voget

Revise & Resubmit at JEEA

-

Earning While Learning: How to Run Batched Bandit Experiments

Co-authors: Jan Kemper

Revise & Resubmit at Stata Journal

-

Inference for Adaptive Experiments

Co-authors: Jan Kemper

NEW

-

Beliefs about Bots: How Employers Plan for AI in White-Collar Work

Co-authors: Eduard Brüll, Samuel Mäurer

NEW

-

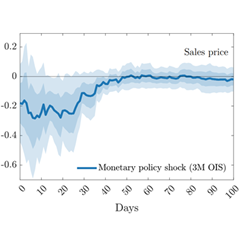

Understanding Firm Dynamics with Daily Data

Co-authors: Lukas Hack

NEW

-

Which Macroeconomic News Matters for Price-Setting?

Co-authors: Lukas Hack

NEW

-

Narratives about Fiscal Policy: Redistribution or Fiscal Consolidation

Co-authors: Laura Arnemann, Florian Buhlmann, Philipp Doerrenberg, Fabian Eble,

Christopher Karlsson, Johannes Voget

NEW

-

Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers

Co-authors: Sebastian Blesse, Florian Buhlmann, Philipp Heil

NEW

-

The Fiscal and Economic Effects of the Biontech Shock

Co-authors: Eckhard Janeba, Felix Köhler, Paul Steger

NEW

-

Occupational Licensing and the Gender Wage Gap

Co-authors: Maria Koumenta, Mario Pagliero

-

Cook, F., Janeba, E., Rostam-Afschar, D. (2025).

Zugang, Auslastung und Öffnungszeiten von Kitas:

Führt bessere Betreuung zu mehr Beschäftigung von Frauen?

Perspektiven der Wirtschaftspolitik, 26(4), 425-440.

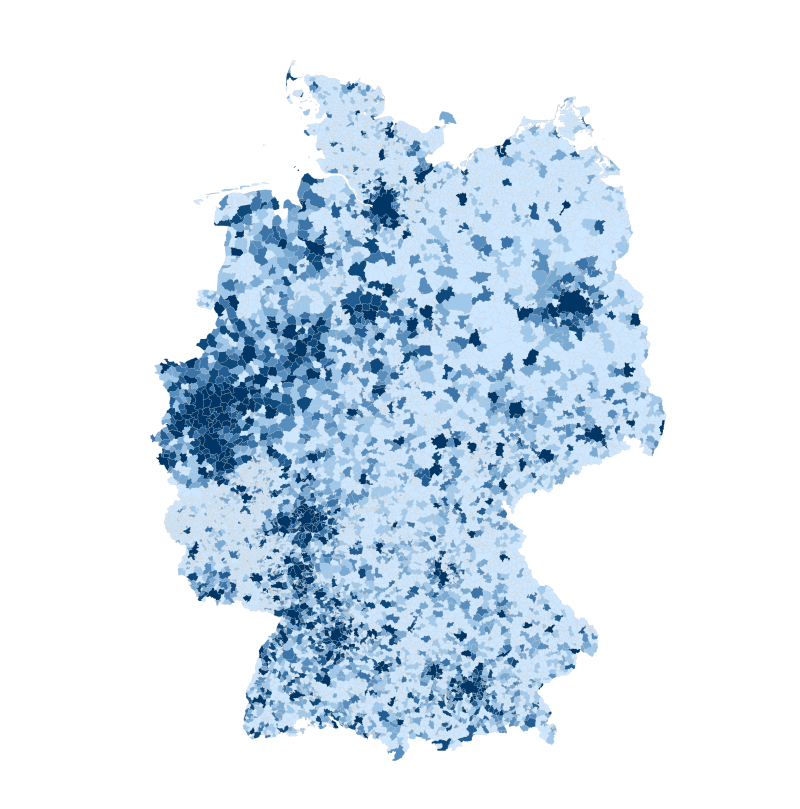

Fehlende Kinderbetreuung gilt als Ursache für Unterschiede in der Beschäftigung von Männern und Frauen. Wir verwenden Daten aus dem Infrastrukturatlas sowie der Raum- und Stadtentwicklungsindikatoren, um die Rolle von Erreichbarkeit, Öffnungszeiten und Nutzung von Kindertagesstätten (Kitas) in Deutschland für die Beschäftigung zu untersuchen. Die Daten umfassen Fahrzeiten von 22,5 Millionen Wohnadressen zu verschiedenen öffentlichen Infrastrukturen, darunter 55.000 Kitas. Wir zeigen, dass Regionen mit besserer Erreichbarkeit, höherer Auslastung und längeren Kitaöffnungszeiten geringere Beschäftigungsunterschiede zwischen Frauen und Männern aufweisen. Die Ergebnisse sind nicht kausal zu interpretieren, die Öffnungszeiten nehmen jedoch eine besonders relevante Rolle ein, die auch nach Berücksichtigung regionaler Charakteristika bestehen bleibt. Eine Überschlagsrechnung legt nahe, dass eine Verbesserung der Kitainfrastruktur die Beschäftigungslücke deutlich verringern und bis zu 950.000 zusätzliche Frauen in sozialversicherungspflichtige Beschäftigung bringen könnte.

-

Gaul, J., Keusch, F., Rostam-Afschar, D., Simon, T. (2025).

Invitation Messages for Business Surveys: A Multi-Armed Bandit Experiment

Survey Research Methods, 19(4), 409-429.

Best Interdisciplinary Paper Award

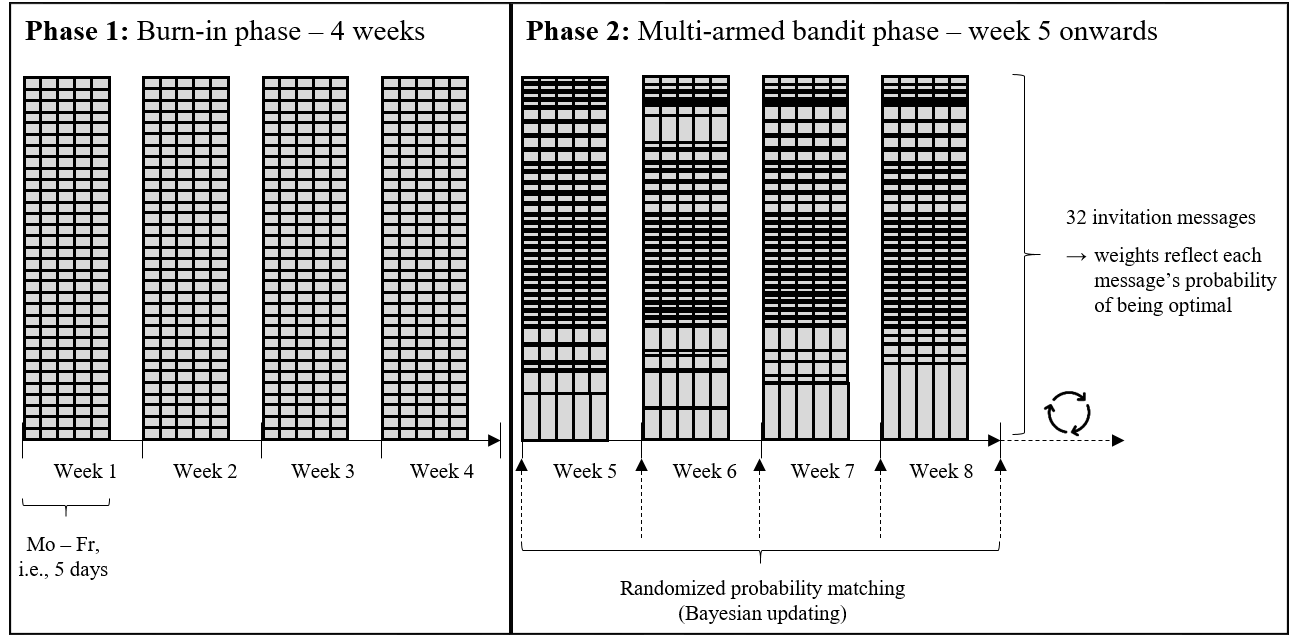

This study investigates how elements of a survey invitation message targeted to businesses influence their participation in a self-administered web survey. We implement a full factorial experiment varying five key components of the email invitation. Unlike traditional experimental setups with static group composition, however, we employ adaptive randomization in our sequential research design. Specifically, as the experiment progresses, a Bayesian learning algorithm assigns more observations to invitation messages with higher starting rates. Our results indicate that personalizing the message, emphasizing the authority of the sender, and pleading for help increase survey starting rates, while stressing strict privacy policies and changing the location of the survey URL have no response-enhancing effect. The implementation of adaptive randomization is useful for other applications of survey design and methodology.

-

Brüll, E., Rostam-Afschar, D., Schlenker, O. (2025).

Cut Off from New Competition: Threat of Entry and Quality of Primary Care

Labour Economics, 92, 102669.

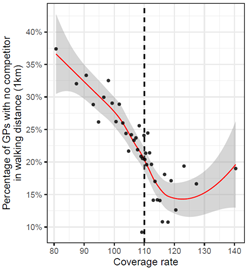

We study how the threat of entry affects service quantity and quality of general practitioners (GPs). We leverage Germany's needs-based primary care planning system, in which the likelihood of new GPs reduces by 20 percentage points when primary care coverage exceeds a cut-off.

We compile novel data covering all German primary care regions and up to 30,000 GP-level observations from 2014 to 2019. Reduced threat of entry lowers patient satisfaction for incumbent GPs without nearby competitors but not in areas with competitors. We find no effects on working hours or quality measures at the regional level including hospitalizations and mortality.

-

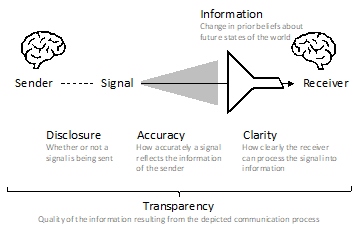

Bischof, J., Gassen, J., Rohlfing-Bastian, A., Rostam-Afschar, D., Sureth-Sloane, C. (2024)

Accounting for Transparency

Schmalenbach Journal of Business Research, 76, 573–611.

This article presents how the Collaborative Research Center TRR 266 Accounting for Transparency understands and studies transparency in organizations and markets. Starting from our transparency definition, which is rooted in a sender/receiver framework, we discuss how accounting, taxation, and their regulation affect transparency and illustrate selected economic consequences of transparency.

We use three analyses to exemplify our research approach.

Overall, we argue that transparency is highly context-specific, non-trivial to achieve, and often has ambiguous consequences. We conclude by highlighting selected transparency-related questions that interdisciplinary work with a particular emphasis on institutional details can meaningfully address. -

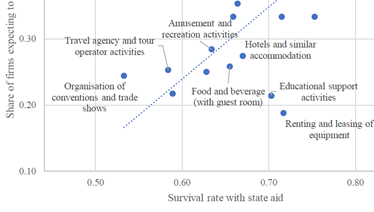

Bischof, J., Dörrenberg, P., Rostam-Afschar, D., Simons, D., Voget, J. (2025)

The German Business Panel: Firm-Level Data for Accounting and Taxation Research

European Accounting Review, 34(4), 1499–1527.

The German Business Panel (GBP) periodically surveys key decision-makers via a large sample of companies in Germany. The survey questions investigate managers' accounting and taxation choices as well as the expected and perceived outcomes of those decisions. To obtain causal evidence, the survey supports the use of randomized survey experiments.

The evidence from the GBP can meaningfully advance our understanding of issues that require data on internal processes as well as expectations, perceptions, and objectives behind ex-post reported accounting figures. The target population comprises the universe of legal entities included in the official German Statistical Business Register. We show that the dominance of small and medium-sized entities is a feature that Germany shares with many European countries, implying that GBP findings will be reasonably generalizable to European settings. We illustrate the usefulness of GBP data by presenting evidence from the initial waves of the GBP during the COVID-19 pandemic. The findings show how government aid programs contributed unevenly to the solvency of the most negatively affected companies, and how companies, rather than consumers, benefited from a temporary reduction of VAT rates. The paper also demonstrates how the scientific community can use the GBP data. -

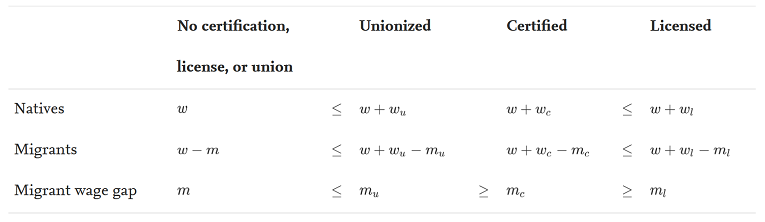

Koumenta, M., Pagliero, M., & Rostam-Afschar, D. (2022).

Occupational Regulation, Institutions, and Migrants’ Labor Market Outcomes.

Labour Economics, 79, 102250.

We study how licensing, certification and unionisation affect the wages of natives and migrants and their representation among licensed, certified, and unionized workers. We provide evidence of a dual role of labor market institutions, which both screen workers based on unobservable characteristics and also provide them with wage setting power. Labor market institutions confer significant wage premia to native workers (4, 1.6, and 2.7 log points for licensing, certification, and unionization respectively), due to screening and wage setting power. Wage premia are significantly larger for licensed and certified migrants (10.3 and 6.6 log points), reflecting a more intense screening of migrant than native workers. The representation of migrants among licensed (but not certified or unionized) workers is 15% lower than that of natives. This again implies a more intense screening of migrants by licensing institutions than by certification and unionization.

-

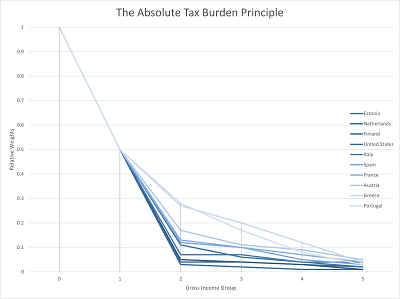

Metzing, M., Jessen, R., & Rostam-Afschar, D. (2022).

Optimal Taxation when the Tax Burden Matters.

Public Finance Analysis, 78, pp. 312-340.

Survey evidence shows that the magnitude of the tax liability plays a role in value judgements about which groups deserve tax breaks. We demonstrate that the German tax-transfer system conflicts with a welfarist inequality averse social planner. It is consistent with a planner who is averse to both inequality and high tax liabilities. The tax-transfer schedule reflects non-welfarist value judgements of citizens or non-welfarist aims of policy makers. We extend our analysis to several European countries and the USA to show that their redistributive systems can be rationalized with an inequality averse social planner for whom the tax burden matters.

-

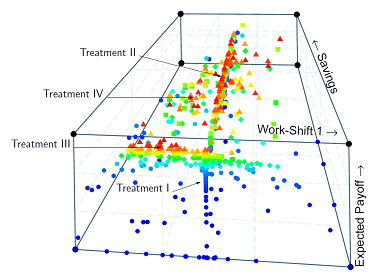

Orland, A., & Rostam-Afschar, D. (2021).

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence.

Journal of Economic Behavior & Organization, 191, 442-481.

In the past years, work-time in many industries has become more flexible, opening up a new channel for intertemporal substitution: workers might, instead of saving, adjust their work-time to smooth consumption. To study this channel, we set up a two-period consumption/saving model with wage uncertainty. This extends the standard saving model by also allowing a worker to allocate a fixed time budget between two work-shifts. To test the comparative statics implied by these two different channels, we conduct laboratory experiments. A novel feature of our experiments is that we tie income to a real-effort style task. In four treatments, we turn on and off the two channels for consumption smoothing: saving and time allocation. Our main finding is that savings are strictly positive for at least 85 percent of subjects. We find that a majority of subjects also uses time allocation to smooth consumption and use saving and time shifting as substitutes, though not perfect substitutes. Part of the observed heterogeneity of precautionary behavior can be explained by risk preferences and motivations different from expected utility maximization.

-

Prettner, K., & Rostam-Afschar, D. (2020).

Can Taxes Raise Output and Reduce Inequality? The Case of Lobbying.

Scottish Journal of Political Economy, 67, pp. 455-461.

One of the key institutional elements for reducing inequality is the tax and transfer system. However, economists and policy makers usually view high taxes as detrimental to economic growth. We isolate one important mechanism by which higher taxes reduce inequality and raise per capita GDP at the same time. This mechanism operates in the presence of unproductive lobbying. Higher taxes induce a reallocation from lobbying toward production. This raises overall output and reduces the consumption gap between those who benefit from lobbying and those who bear its negative effects. -

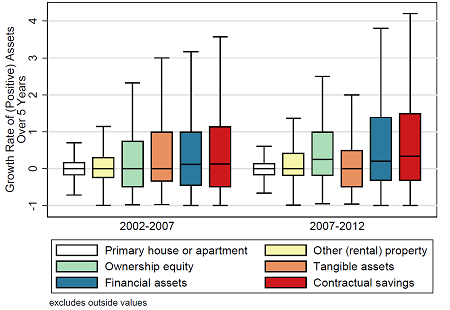

Fossen, F. M., Rees, R., Rostam-Afschar, D., & Steiner, V. (2020).

The Effects of Taxation on Entrepreneurial Investment: A Puzzle?

International Tax and Public Finance, 27, pp. 1321-1363.

We investigate how personal income taxes affect the portfolio share of personal wealth that entrepreneurs invest in their own business. In a portfolio choice model that allows for tax sheltering, we show that lower tax rates may increase investment in entrepreneurial equity at the intensive margin, but decrease it at the extensive margin. Using German panel data, we identify tax effects on the portfolio shares of six asset classes by exploiting tax and entry regulation reforms. Our results indicate that lower taxes drive out businesses that are viable only due to tax sheltering, but increase investment in productive entrepreneurial businesses.

-

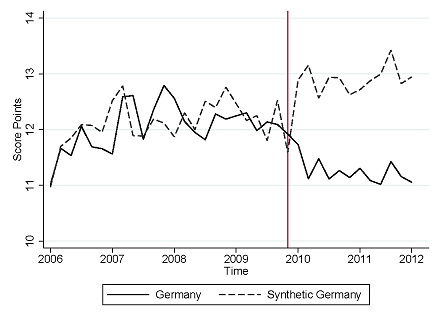

Rostam-Afschar, D., & Strohmaier, K. (2019).

Does Regulation Trade-Off Quality against Inequality?

British Journal of Industrial Relations, 57(4), pp. 870–893.

We exploit an exogenous price increase by about 10% for architectural services to answer the question how price regulation affects income inequality and service quality. Using individual-level data from the German microcensus for the years 2006 to 2012, we find a significant reform effect of 8% on personal net income for self-employed architects and construction engineers. This group moved from the second lowest to the highest quintile of the net income distribution. This increase in inequality is associated with a deterioration of service quality. The reform reduced average scores of a peer ranking for architects by 18%.

-

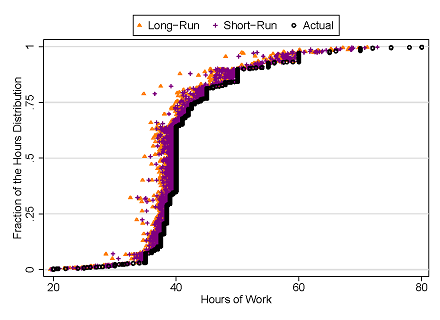

Jessen, R., Rostam-Afschar, D., & Schmitz, S. (2018).

How Important is Precautionary Labor Supply?

Oxford Economic Papers, 70(3), pp. 868–891.

We quantify the importance of precautionary labour supply defined as the difference between hours supplied in the presence of risk and hours under perfect foresight. Using the German Socio-Economic Panel from 2001 to 2012 we estimate the effect of wage risk on labour supply and test for constrained adjustment of labour supply. We find that married men choose on average about 2.8% of their hours of work to shield against wage shocks. The effect is strongest for self-employed who we find to be unconstrained in their hours choices, but also relevant for other groups with more persistent hours constraints. If the self-employed faced the same wage risk as the median civil servant, their hours of work would reduce by 4.5%.

-

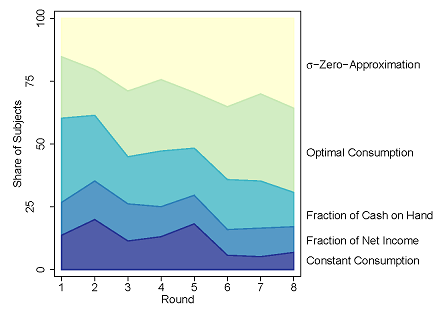

Meissner, T., & Rostam-Afschar, D. (2017).

Learning Ricardian Equivalence.

Journal of Economic Dynamics and Control, 82, pp. 273-288.

This paper tests whether subjects learn to comply with the Ricardian Equivalence proposition in a life cycle consumption laboratory experiment. Our results suggest that Ricardian Equivalence does not hold on average: tax changes have a significant and strong impact on consumption choice. Using individual consumption time series, the behaviour of 56% of our subjects can be classified as inconsistent with the Ricardian Equivalence proposition. Classifying subjects according to rules of thumb that best describe their behaviour, we find that subjects switch less to rules that theoretically violate Ricardian Equivalence in later rounds compared to earlier rounds. This implies that some subjects learn to comply with Ricardian Equivalence by changing their consumption strategy. However, the aggregate effect of taxation on consumption persists, even after eight rounds of repetition.

-

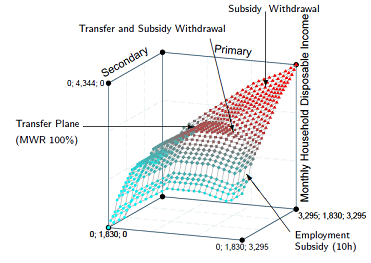

Jessen, R., Rostam-Afschar, D., & Steiner, V. (2017).

Getting the Poor to Work: Three Welfare Increasing Reforms for a Busy Germany.

Public Finance Analysis, 73(1), pp. 1-41.

We study three budget-neutral reforms of the German tax and transfer system designed to improve work incentives for people with low incomes: a feasible flat tax reform that provides a basic income which is equal to the current level of the means tested unemployment benefit, and two alternative reforms that involve employment subsidies to stimulate participation and full-time work, respectively. We estimate labor supply reactions and welfare effects using a microsimulation model based on household data from the Socio-Economic Panel (SOEP) and a structural labor supply model. We find that all three reforms increase labor supply in the first decile of the income distribution. However, the flat tax scenario reduces overall labor supply by 4.9%, the reform scenario designed to increase participation reduces labor supply by 1%, while the reform that provides improved incentives to work full-time has negligible effects on overall labor supply. With equal welfare weights, aggregate welfare gains are realizable under all three reforms.

-

Rostam-Afschar, D. (2014).

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship.

Empirical Economics, 47(3), pp. 1067-1101.

Reprinted in

Holtemöller, O. (ed.), (2017). How Can We Boost Competition in the Services Sector?, Baden-Baden: Nomos, pp. 89-133.

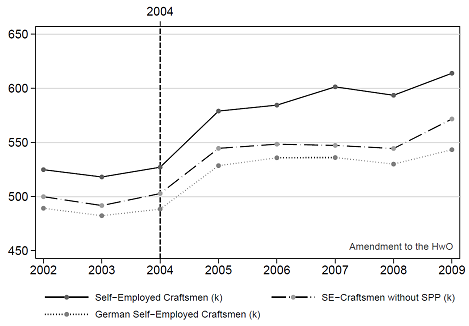

This paper uses the 2004 amendment to the German Trade and Crafts Code as a natural experiment for assessing the causal effects of this reform on the probabilities of being self-employed and of transition into and out of self-employment. This is achieved by using repeated cross-sections (2002-2009) of German microcensus data. I apply the difference-in-differences technique for three groups of craftsmen which were subject to different intensities of treatment. The results show that the complete exemption from the educational entry requirement has fostered self-employment significantly by substantially increasing the entry probabilities, while exit rates have remained unaffected. I find similar, though weaker relative effects for the treatment groups that were subject to a reduction of entry costs or a partial exemption from the entry requirements. Moreover, I consider effect heterogeneity within each of the treatment groups with respect to gender and vocational training, and show that the deregulation of entry requirements has been most effective for untrained workers.

-

Fossen, F. M., & Rostam-Afschar, D. (2013).

Precautionary and Entrepreneurial Savings: New Evidence from German Households.

Oxford Bulletin of Economics and Statistics, 75(4), pp. 528–555.

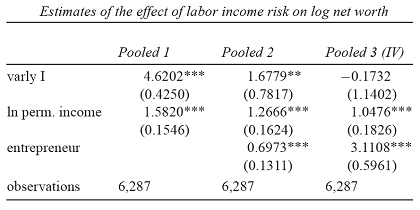

Various studies interpret the positive correlation between income risk and wealth as evidence of significant precautionary savings. However, these high estimates emerge from pooling non-entrepreneurs and entrepreneurs, without controlling for heterogeneity. This article provides evidence for Germany based on representative panel data that includes private wealth balance sheets. Entrepreneurs, who face high income risk, hold more wealth than employees, but this tendency is not because of precautionary motives. Instead, they appear to save more for their old age, because they are usually not covered by statutory pension insurance. The analysis accounts for endogeneity in entrepreneurial choice and heterogeneous risk attitudes.

-

Blesse, S., Heil, P., & Rostam-Afschar, D. (2025).

Wahrnehmung und Realität im kommunalen Standortwettbewerb:

Auswertungen einer Unternehmensbefragung für Sachsen und Ostdeutschland

KOMKIS Report Nr. 15.

-

Blesse, S., Botta, F., Hesse, M., Heil, P., & Rostam-Afschar, D. (2025).

Was Unternehmen wollen: Einschätzungen zu Standortbedingungen von Unternehmen

KOMKIS Report Nr. 14.

-

Blesse, S., Heil, P., & Rostam-Afschar, D. (2025).

Kommunaler Standortwettbewerb und Investitionen von Unternehmen.

ifo Schnelldienst, 78(05), 53-57.

-

Bischof, J., Liu, Y., & Rostam-Afschar, D. (2023).

Bilanzpolitik in aktuellen Unternehmenskrisen: empirische Befunde, Chancen und Risiken.

Betriebs-Berater, 78(17), 939-942.

-

Bischof, J., Karlsson, C., Rostam-Afschar, D., Simon, T., & Simons, D. (2022).

Kostenstruktur und Unternehmensflexibilität in der COVID-19-Krise.

Controlling & Management Review, 66(7), 54-59.

-

Bischof, J., Dörrenberg, P., Rostam-Afschar, D., Simon, T., & Voget, J. (2022).

Kriegsauswirkungen auf Unternehmen: Energieabhängigkeit und Preiserhöhungen.

Wirtschaftsdienst, 102(9), 724-730.

-

Bischof, J., Karlsson, C., Rostam-Afschar, D., & Simon, T. (2021).

Die Bedeutung der Kostenstruktur für die Effektivität von Staatshilfen.

Wirtschaftsdienst, 101(7), 536.

-

Bischof, J., Dörrenberg, P., Eble, F., Karlsson, C., Rostam-Afschar, D., Simons, D., & Voget, J. (2021).

German Business Panel:

Empirische Evidenz zu den Auswirkungen der Corona-Krise auf deutsche Unternehmen.

Der Betrieb, 18, pp. 909-912.

-

Rostam-Afschar, D. (2020).

Inklusive Beschäftigungspolitik:

Fakten, Herausforderungen und neue Ideen zur Regulierung von Berufen.

Zeitschrift für Wirtschaftspolitik, 69(2), 129-139.

-

Koumenta, M., Pagliero, M., & Rostam-Afschar, D. (2018).

Effects of Regulation on Service Quality: Evidence From Six European Cases.

European Commission Research Report, Directorate General Internal Market,

Industry Entrepreneurship and SMEs.

-

Rostam-Afschar, D. (2015).

Regulatory Effects of the Amendment to the HwO in 2004 in German Craftsmanship.

European Commission Research Report, Directorate General Internal Market and Services.

-

How Risk Averse and how Prudent are Workers?

Co-authors: Robin Jessen

-

Labor Income Uncertainty and Fertility Decisions: Evidence from the German Socio-Economic Panel

Co-authors: Sebastian Schmitz

-

Progressive Taxation and Precautionary Saving Over the Life Cycle

Co-authors: Jiaxiong Yao

Current Research Papers

Refereed Publications

Invited Articles and Policy Reports

In Progress (since longer)

- Jan 2026

- ASSA, Österreichische Nationalbank, Universität Hannover, Universität Duisburg-Essen

- Feb 2026

- Mannheim Research Colloquium on Survey Methods

- Mar 2026

- KOF-Research Seminar Zurich

- Jul 2026

- LUISS Rome

- The Geostrata

Globalism, Tariffs, and Tensions: Role of Trump Administration on Global Trade - Oceania Stata Conference

How to Run Adaptive Experiments in Stata - NZ Treasury Guest Lecture

Productivity in a Changing World: Insights from Product and Labour Markets - Federal Reserve Banks of Minneapolis and Chicago

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - OECD

The Economic Consequences of Occupational Licensing - TRR 266 Accounting for Transparency

Is There an Ideal Level of Transparency? - Universidad de Navarra

Freedom of Movement, Taxation and Job Mobility in Europe - Mar 2026

- KOF Research Seminar

tbd - Feb 2026

- MaRCS

tbd - Jan 2026

- Universität Duisburg-Essen

tbd - Jan 2026

- Brown Bag, Hannover

tbd - Jan 2026

- OeNB, Vienna

Which Macroeconomic News Matter for Price-Setting? - May & Sep 2025

- ZEW Finanzmarkttest

Frictions in Forecasting: Experimental Evidence on How Forecasters Form Their Forecasts - Apr 2025

- Universität Duisburg-Essen

When the Tax Machine Cometh: Who Benefits from Automation? - Feb 2025

- Öffentliche Podiumsdiskussion, Universität Mannheim

Politische und wirtschaftliche Weichenstellungen nach der Wahl - Jan 2025

- ifm DT4SME Session Innovative Use of Secondary Data

What Can We Learn from Business Surveys? Designs, Challenges and Opportunities - Sept 2024

- University of Mannheim: Data Science in Action

Earning While Learning: How to Run Batched Bandit Experiments - Sep 2024

- IAB Nürnberg

Earning While Learning: How to Run Batched Bandit Experiments - Jul 2024

- Universität Tübingen

Freedom of Movement, Taxation and Job Mobility in Europe - Mar 2024

- Te Tai Ōhanga NZ Treasury, Wellington

Occupational Regulation, Institutions, and Migrants’ Labor Market Outcomes - Mar 2024

- Te Pūtea Matua Reserve Bank of NZ, Wellington

Followers or Ignorants? Inflation Forecasts and Price Setting Behavior of Firms - Mar 2024

- University of Sydney

Entry Regulation and Employment - Mar 2024

- UOW

Entry Regulation and Employment - Mar 2024

- Melbourne Institute

Entry Regulation and Employment - Feb 2024

- West Virginia University

Entry Regulation and Provision of Medical Services - Aug 2023

- OsloMet

Occupational Regulation, Institutions, and Migrants’ Labor Market Outcomes - Jul 2023

- ZEW Research Seminar

What Can We Learn from Survey Experiments? Designs, Challenges and Opportunities - Jun 2023

- Freie Universität Berlin

Followers or Ignorants? Inflation Forecasts and Price Setting Behavior of Firms - May 2023

- Stadt Mannheim

What Makes a Location Attractive for Business? Evidence from Firm Decision Makers - Jan 2023

- RWI Essen

Followers or Ignorants? Inflation Forecasts and Price Setting Behavior of Firms - Apr 2022

- ZEW, Unit Corporate Taxation and Public Finance

The German Business Panel: Why? Who? Where? And What?! - Jan 2022

- University of Mannheim

Freedom of Movement, Taxation and Job Mobility in Europe - Jan 2022

- ZEW Research Seminar

Occupational Regulation, Institutions, and Migrants' Labor Market Outcomes - Jun 2021

- Jönköping Interntaitonal Business School

Freedom of Movement, Taxation and Job Mobility in Europe - Apr 2021

- Round Table Mittelstand

Wie können Unternehmen strukturerhaltend durch die Krise kommen? - Oct 2020

- University of Paderborn

The German Business Panel: Scope, Methods, and Potential for Analysis - Dec 2020

- Bundesministerium für Wirtschaft und Energie

German Business Panel: Empirische Erkenntinsse zu Lockdown und Staatshilfe - Sep 2020

- LMU München

Preliminary Findings of the TRR 266 COVID-19-Survey - Mar 2020

- University of Konstanz

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Nov 2019

- University of Navarra

Freedom of Movement, Taxation and Job Mobility in Europe - Nov 2019

- Banca d'Italia

Freedom of Movement, Taxation and Job Mobility in Europe - Oct 2019

- Oslo Fiscal Studies and Statistics Norway

Freedom of Movement, Taxation and Job Mobility in Europe - Oct 2019

- OECD

The Economic Consequences of Occupational Licensing - Apr 2019

- University of Maastricht

Occupational Licensing, Taxation, and Job Mobility in Europe - Mar 2019

- University of Exeter

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Mar 2019

- RWI Essen

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Feb 2019

- European Commission, Brussels

Effects of regulation on service quality: Evidence from six European cases - Oct 2018

- University of Basel

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Sept 2018

- Federal Reserve Banks of Minneapolis and Chicago

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Sept 2018

- San Francisco State University

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Sept 2018

- University of California, Berkeley

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Apr 2018

- University of Nevada, Reno

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Mar 2018

- University of California, Berkeley

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Oct 2017

- University of Hohenheim

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Oct 2017

- Collegio Carlo Alberto, Turin

Does Regulation Trade-Off Quality against Inequality? The Case of German Architects and Construction Engineers - Nov 2017

- Linnaeus University, Växjö

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Nov 2017

- European Commission, Brussels

Professional Services: How does Regulation Matter? - June 2017

- Centre for European Economic Research (ZEW), Mannheim

Is our Income too Risky to have a(nother) Baby? Evidence from German Micro Data - July 2016

- SRH University Berlin, Berlin

Theoretical and Empirical Foundations of Policy Evaluation: The Case of Basic Income - July 2016

- Institut für Wirtschaftsforschung Halle (IWH) and Representation of the European Commission in Germany, Berlin

Past Reforms in the Services Sector in Germany and their Effects - May 2016

- Deutsche Bundesbank, Frankfurt

Progressive Taxation and Precautionary Saving Over the Life Cycle - Jan 2016

- Technische Universität Chemnitz, Chemnitz

Auswirkungen von Lohnunsicherheit auf die jährlichen Arbeitsstunden - June 2015

- Universitat de Barcelona, Institut d'Economia de Barcelona, Barcelona

Do Tax Cuts Increase Consumption - June 2015

- European Commission (Group of Coordinators for the Recognition of Professional Qualifications), Brussels

Mutual Evaluation of Regulated Professions - May 2015

- World Bank, Warsaw

Seminar on Deregulation of Access to Professions - Jan 2015

- European Commission (Representation of the European Commission in Germany), Brussels

In-Depth Session on Services in Germany - Jan 2026

- ASSA

Understanding Firm Dynamics with Daily Data - Nov 2025

- TRR Annual Conference

The Art of Asking: Insights from the German Business Panel - Nov 2025

- Understanding Business Conditions, Expectations and Uncertainty, London

Which Macroeconomic News Matters for Price-Setting? - Nov 2025

- NTA Annual Conference, Boston

Beliefs about Bots: How Employers Plan for AI in White-Collar Work, Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers - Nov 2025

- Mannheim Taxation Campus Meeting

Discussion of Missing Trader VAT Fraud: Evidence from Cross-Border Audits in the EU - Oct 2025

- Swiss Workshop on Local Public Finance and Regional Economics, Lugano

Tax and Vax: The Fiscal and Economic Effects of the Biontech Shock - Sep 2025

- VfS Annual Meeting

The Asymmetric Incidence of Business Taxes: Survey Evidence from German Firms, Occupational Licensing and the Gender Wage Gap, Beliefs about Bots: How Employers Plan for AI in White-Collar Work (Impromptu) - Sep 2025

- Workshop on Field Experiments in Economics and Business, Heilbronn

Beliefs about Bots: How Employers Plan for AI in White-Collar Work - Sep 2025

- Economic Modeling and Data Science, Stuttgart

Which Macroeconomic News Matter for Price-Setting? - Aug 2025

- IIPF

Beliefs about Bots: How Employers Plan for AI in White-Collar Work, Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers - Jul 2025

- European Survey Research Association, Utrecht

Understanding Firm Dynamics with Daily Data - Jun 2025

- Swiss Society of Economics and Statistics, Zurich

Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers - May 2025

- EAA, Rome

Narratives about Fiscal Policy: Redistribution or Fiscal Consolidation - May 2025

- Workshop on Frontiers in Measurement and Survey Methods, Naples

Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers - Apr 2025

- Mannheim Taxation Campus Meeting

Beliefs about Bots: How Employers Plan for AI in White-Collar Work - Mar 2025

- Deutschen Gesellschaft für Gesundheitsökonomie (dggö), Paderborn

Cut Off from New Competition: Threat of Entry and Quality of Primary Care - Mar 2025

- Society for Nonlinear Dynamics and Econometrics, San Antonio

Understanding Firm Dynamics with Daily Data - Mar 2025

- Workshop in Empirical Macroeconomics, Linz

Which Macroeconomic News Matter for Price-Setting? - Mar 2025

- CNB Conference on Real-Time Data Analysis, Prague

Understanding Firm Dynamics with Daily Data - Feb 2025

- Research Seminar in Public Economics, Mannheim

Local Policy Misperceptions and Investment: Experimental Evidence from Firm Decision Makers - Jan 2025

- Oceania Stata Conference

Earning While Learning: How to Run Batched Bandit Experiments - Jan 2025

- ASSA 2025, San Francisco

Central Bank Inflation Forecasts and Firms' Price Setting in Times of High Inflation - Nov 2024

- Workshop at TRR 266 Annual Conference, Paderborn

Earning While Learning: How to Run Batched Bandit Experiments - Sep 2024

- Nordic Conference in Behavioral and Exerimental Economics, Copenhagen

What Makes a Location Attractive for Business? Evidence from Firm Decision Makers - Sep 2024

- Verein für Socialpolitik, Berlin

Understanding Firm Dynamics with Daily Data - Sep 2024

- 4 Unis Conference, Frankfurt

Understanding Firm Dynamics with Daily Data - Aug 2024

- TRR Workshop, Frankfurt

Do Managers Consider Earnings Management Sensitive? - June 2024

- ILERA, New York City

Doctors Crossing Borders - Mar 2024

- VHB, Lüneburg

No Incidence Left Behind: Towards a Complete Understanding of Tax Incidence - Sep 2023

- Reconnect Workshop, Oslo

Occupational Licensing and Migration Evidence from the EU - Aug 2023

- European Economic Association and Econometric Society European Meeting, Manchester, Barcelona

Fiscal Stimulus and Consumption Spending: Evidence from a 5 Billion Euro Experiment, Entry Regulation and Employment - June 2023

- Taxation and Mobility Workshop, ZEW Mannheim

Freedom of Movement, Taxation and Job Mobility in Europe - June 2023

- IAB, Nürnberg

Entry Regulation and Employment - June 2023

- Advanced Pharmaco & Health Economics, Genova

Entry Regulation and Employment - May 2023

- Workshop on Empirical Macroeconomics Ghent

Followers or Ignorants? Inflation Expectations and Price Setting Behavior of Firms - May 2023

- Society of Labor Economists, Philadelphia

Entry Regulation and Employment - Apr 2023

- Next Generation Economics, Mannheim

Entry Regulation and Employment - Feb 2023

- Research Seminar in Public Economics, Mannheim

Entry Regulation and Employment: Evidence from Retail and Labor Markets of Pharmacists - Oct 2022

- Next Generation Economics, Hohenheim

How Do Firm Decision-Makers Form Preferences About Fiscal Policy? - Sep 2022

- Verein für Socialpolitik, Basel

Occupational Regulation, Institutions, and Migrants' Labor Market Outcomes - Sep 2022

- European Association of Labour Economists, Padua

Entry Regulation and Employment: Evidence from Retail and Labor Markets of Pharmacists - Aug 2022

- Tax Administration Research Centre, Online

Fiscal Stimulus and Consumption Spending: Evidence from a 5 Billion Euro Experiment - Jun 2022

- IAAE 2022, London

Fiscal Stimulus and Consumption Spending: Evidence from a 5 Billion Euro Experiment - Jun 2022

- ESPE 2022, Calabria

Occupational Regulation, Institutions, and Migrants' Labor Market Outcomes - Jun 2022

- ESA 2022, Boston

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Jun 2022

- AFE, Chicago

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Jan 2022

- ASSA 2022 Virtual

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Dec 2021

- GBP Scientific Board Meeting

The GBP: Scope, Methods, and Potential for Analysis - Dec 2021

- Public Economics Research Seminar, University of Mannheim

Intertemporal Substitution and Substitutability Between Consumption Goods - Nov 2021

- TRR 266 Annual Conference 2021

The German Business Panel - Oct 2021

- Workshop on the Socio-Economics of Ageing

Discussant for: The Impact of Health Shocks on Savings in Old Age - Oct 2021

- MannheimTaxation Campus Meeting

Discussant for: Increased Tax Transparency or Data Overload? - Sep 2021

- Verein für Socialpolitik, virtual

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Aug 2021

- European Economic Association and Econometric Society European Meeting, virtual

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Aug 2021

- International Institute of Public Finance, virtual

The German Business Panel: Insights on Corporate Taxation and Accounting during the Covid-19 Pandemic - Aug 2021

- International Institute of Public Finance, virtual

How do Firm Decision-Makers form Preferences about Fiscal Policy? - Jun 2021

- COMPIE, virtual

Freedom of Movement, Taxation and Job Mobility in Europe - Jun 2021

- Experimental Finance Conference, virtual

Flexible Work Arrangements and Precautionary Behavior: Theory and Experimental Evidence - Jun 2021

- European Society for Population Economics, virtual

Occupational Licensing and the Gender Wage Gap - Jun 2021

- TRR 266 Brown Bag, virtual

The German Business Panel: A Look under The Hood - May 2021

- SOLE

Freedom of Movement, Taxation and Job Mobility in Europe - May 2021

- ZEW Public Finance

Freedom of Movement, Taxation and Job Mobility in Europe - May 2021

- International Industrial Organization Conference

Entry Regulation and Competition: Evidence from Retail and Labor Markets of Pharmacists - Jan 2021

- LERA@ASSA 2021 Virtual

Occupational Regulation and the Migrant Wage Gap - June 2020

- EALE/SOLE/AASLE Virtual World Conference

Occupational Licensing and the Gender Pay Gap - Jan 2020

- LERA@ASSA 2020 San Diego, California

Freedom of Movement, Taxation and Job Mobility in Europe - Dec 2019

- CESifo Norwegian-German Seminar, München

Fiscal Stimulus and Intratemporal Consumption Spending Evidence from a 5 Billion Euro Experiment - Dec 2019

- Tübingen-Hohenheim-Economics, Hohenheim

Freedom of Movement, Taxation and Job Mobility in Europe - Sept 2019

- Verein für Socialpolitik, Leipzig

Freedom of Movement, Taxation and Job Mobility in Europe - Sept 2019

- European Association of Labour Economists, Uppsala

Freedom of Movement, Taxation and Job Mobility in Europe - Sept 2019

- 9th ifo Dresden Workshop on Regional Economics

Freedom of Movement, Taxation and Job Mobility in Europe - April 2019

- European Economic Association and Econometric Society European Meeting, Manchester

Freedom of Movement, Taxation and Job Mobility in Europe - April 2019

- Society for the Study of Economic Inequality, Paris

Optimal Taxation Under Different Concepts of Justness - June 2019

- International Association for Applied Econometrics, Nicosia

Freedom of Movement, Taxation and Job Mobility in Europe - June 2019

- GSE Summer Forum, Barcelona

Occupational Licensing, Taxation, and Job Mobility in Europe - June 2019

- Workshops on Public Economics, Barcelona

Occupational Licensing, Taxation, and Job Mobility in Europe - April 2019

- Brown Bag Seminar, Hohenheim

Occupational Licensing, Taxation, and Job Mobility in Europe - Nov 2018

- Tübingen-Hohenheim-Economics, Hohenheim

Does Regulation Trade-Off Quality vs. Inequality? - Nov 2018

- National Tax Association, New Orleans

Optimal Taxation Under Different Concepts of Justness - Oct 2018

- G-Forum, Hohenheim

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Sept 2018

- COMPIE, BERLIN

Does Regulation Trade-Off Quality against Inequality? The Case of German Architects and Construction Engineers - June 2018

- IAAE, Montreal

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Nov 2017

- Tübingen-Hohenheim-Economics, Hohenheim

How Important is Precautionary Labour Supply? - Sept 2017

- MaTax, Mannheim

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Sept 2017

- Verein für Socialpolitik, Wien

Consumption Insurance, Welfare, and Optimal Progressive Taxation - Aug 2017

- European Economic Association, Lisbon

How Do Entrepreneurial Portfolios Respond to Income Taxation? - Jan 2017

- Allied Social Sciences Associations (ASSA) Annual Meeting, Chicago

How Important is Precautionary Labour Supply? - Jan 2017

- Allied Social Sciences Associations (ASSA) Annual Meeting, Chicago

A Just and Optimal Tax Schedule - Sept 2016

- European Association of Labour Economists, Ghent

How Important is Precautionary Labour Supply? - Sept 2016

- Verein für Socialpolitik, Augsburg

Uncertainty and Fertility Decisions: Evidence from German Micro Data - Aug 2016

- European Economic Association, Geneva

How Risk Averse and how Prudent are Workers? - Aug 2016

- International Institute of Public Finance, Lake Tahoe

A Just and Optimal Tax System - June 2016

- Society for Social Choice and Welfare, Lund

A Just and Optimal Tax System - June 2016

- Early-Career Behavioral Economics Conference, Behavior and Inequality Research Institute, Bonn

Harnessing the Wisdom of Crowds by Da and Huang - June 2016

- International Association for Applied Econometrics, Milan

Uncertainty and Fertility Decisions: Evidence from German Micro Data - May 2016

- Hohenheim Spring School, University of Hohenheim

Bias in Idiosyncratic Income Inequality - May 2016

- Brown Bag Seminar, University of Hohenheim

Progressive Taxation and Precautionary Saving Over the Life Cycle - Dec 2015

- Public Finance Workshop WZB Berlin, Berlin

Getting the Poor to Work: Three Welfare Increasing Reforms for a Busy Germany? - Dec 2015

- Simposio of the Spanish Economic Association, Girona

How Risk Averse and how Prudent are Workers? - Aug 2015

- European Economic Association, Mannheim

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - June 2015

- International Association for Applied Econometrics, Thessaloniki

How Risk Averse and how Prudent are Workers? - June 2015

- 1st BeNA Labor Economics Workshop, Berlin

How Important is Precautionary Labour Supply? - Apr 2015

- Brown Bag Seminar, Humboldt University of Berlin

How Risk Averse and how Prudent are Workers? - Apr 2015

- Network for Integrated Behavioural Science, Nottingham

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Dec 2014

- Simposio of the Spanish Economic Association, Palma de Mallorca

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Nov 2014

- Public Finance Workshop WZB Berlin, Berlin

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Nov 2014

- BeNA Seminar on Labor Research, Berlin

Uncertainty and Fertility Decisions: Evidence from German Micro Data - Oct 2014

- PhD Workshop Public Economics DIW Berlin, Berlin

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Sept 2014

- CenEA Research Workshop on Optimizing Over the Lifetime, Warsaw

Progressive Taxation and Precautionary Saving Over the Life Cycle - Sept 2014

- Berlin Behavioral Economics Workshop, Berlin

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Sept 2014

- Verein für Socialpolitik, Hamburg

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Sept 2014

- Economic Science Association, Prague

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - Aug 2014

- International Institute of Public Finance, Lugano

Do Tax Cuts Increase Consumption? An Experimental Test of Ricardian Equivalence - June 2014

- International Association for Applied Econometrics, London

Progressive Taxation and Precautionary Saving Over the Life Cycle - June 2014

- Journées Louis-André Gérard-Varet, Aix-en-Provence

Progressive Taxation and Precautionary Saving Over the Life Cycle - June 2014

- European Society for Population Economics, Braga

Progressive Taxation and Precautionary Saving Over the Life Cycle - May 2014

- Economic Policy Seminar, Berlin

Uncertainty and Fertility Decisions: Evidence from German Micro Data - Oct 2013

- Economic Policy Seminar, Berlin

Taxation and Precautionary Savings over the Life Cycle - Aug 2013

- European Economic Association and Econometric Society European Meeting, Gothenburg

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - Aug 2013

- International Institute of Public Finance, Taormina

Taxation and Precautionary Savings over the Life Cycle - July 2013

- PhD Workshop Public Economics, DIW Berlin

Taxation and Precautionary Savings over the Life Cycle - June 2013

- Brown Bag Seminar, Humboldt University of Berlin

Taxation and Precautionary Savings over the Life Cycle - Feb 2013

- BeNA Seminar on Labor Research, Berlin

Taxation and Precautionary Savings over the Life Cycle - Jan 2013

- Economic Policy Seminar, Berlin

Taxation and Precautionary Savings over the Life Cycle - Sept 2012

- Verein für Socialpolitik, Annual Meeting, Göttingen

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - May 2012

- Economic Policy Seminar, Berlin

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - Dec 2011

- Economic Policy Seminar, Berlin

Taxes and Entrepreneurial Portfolio Investment - Feb 2011

- Ruhr Graduate School Doctoral Conference in Economics, Dortmund

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - Oct 2010

- BeNA Seminar on Labor Research, Berlin

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - Jan 2010

- Economic Policy Seminar, Berlin

Entry Regulation and Entrepreneurship: A Natural Experiment in German Craftsmanship - Jan 2009

- Economic Policy Seminar, Berlin

Precautionary Saving and Entrepreneurship: Evidence from German Households

Upcoming Presentations

Recorded Talks

Invited Presentations

Other Presentations

Recent Positions

- Associate Professor (W2)

University of Mannheim - Visiting Professor (Lehrstuhlvertretung)

University of Mannheim - Assistant professor (Akademischer Rat)

University of Hohenheim

Recent Research Visits

- Harvard University

invited by Stefanie Stantcheva - Queen Mary University, London

invited by Maria Koumenta - University of California, Berkeley

invited by Alan J. Auerbach - Johns Hopkins University

invited by Christopher Carroll

Education

- Dr. rer. pol. (PhD in Economics), summa cum laude

Freie University of Berlin

Supervisors: Prof. Dr. Viktor Steiner, Prof. Sir Richard Blundell

- Diploma in Economics (Diplom Volkswirt),

Freie University of Berlin

Tool for running adaptive experiments

- BBANDITS: Stata Module to Estimate Batched OLS for Multi-Armed Bandits

- XTSTEADYSTATE: Stata module to estimate markov chain dynamics and steady states

- GRAPH3D: Stata module to draw colored, scalable, rotatable 3D plots

Stata user written command, RePEc

Ado Files

Lectures, Slides, Code

Teaching Files

Media

- Aug 25, 2025

- Uni Mannheim: Wirtschaft von Aufbruchstimmung weit entfernt

Mannheimer Morgen - Jun 31, 2025

- Die US-Zollpolitik und ihre Folgen: Das sagen Unternehmen der Region

econo, AUSGABE 02/25 - Jun 11, 2025

- Was steckt hinter Trumps Strafzöllen?

ARD plusminus

- Apr 23, 2025

- Wie reagieren die Unternehmen auf höhere US-Zölle?

Mannheimer Morgen - Mar 01, 2025

- Was Mannheimer Wissenschaftler zur möglichen Koalition sagen

Mannheimer Morgen - Feb 22, 2025

- Wirtschaft setzt auf CDU/CSU und fordert Bürokratieabbau

Mannheimer Morgen - Oct 04, 2024

- Was vom Tage übrig bleibt

VDI nachrichten - Apr 23, 2024

- Wirtschaftspolitik - die Ampel bekommt schlechte Noten

Mannheimer Morgen - Jul 25, 2023

- Studie der Universität Mannheim: Unternehmen befürchten Steuererhöhungen

Mannheimer Morgen - Apr 16, 2023

- Inflation: Ökonomen geben voerst noch keine Entwarnung

Leadersnet Deutschland - Mar 17, 2023

- Schnelles Internet wichtiger als niedrige Gewerbesteuer

Mannheimer Morgen - Aug 15, 2022

- Umfrage der Universität Mannheim: Unternehmen erwarten großes Minus bei den Gewinnen

Mannheimer Morgen - Mai 31, 2022

- Umfrage der Universität Mannheim: Viele Betriebe scheuen Investitionen und Neueinstellungen

Mannheimer Morgen - Apr 14, 2022

- Deutschland: Vier von fünf Unternehmen erwarten Belastungen durch Ukraine-Krieg

Handelsblatt - Feb 15, 2022

- Mannheimer Unternehmensumfrage: Gewinne der Betriebe legen im Januar kräftig zu

Mannheimer Morgen - Jan 23, 2022

- Unternehmen habe gespaltene Meinungen zu 3G

Rhein-Neckar-Zeitung - Jan 16, 2022

- Mannheimer Umfrage: Viele Unternehmen haben wegen Corona Angst vor Pleite

Mannheimer Morgen - Sept 7, 2020

- Büros stellen Lohnerhöhungen auf den Prüfstand

Competitionline - Aug 10, 2020

SWR Aktuell- Aug 10, 2020

WDR 5 Profit- Aug 10, 2020

- Staatshilfe rettet in der Krise viele Betriebe

Süddeutsche Zeitung - Nov 14, 2019

- Freedom of Movement, Taxation and Job Mobility in Europe

Universidad de Navarra - Oct 11, 2019

- The economic consequences of occupational licensing

OECD - Mar 6, 2018

- "How will universal basic income change our lives?"

Dialogue of Civilizations Research Institute. - Sept 15, 2016

- "Die Zukunft des Handwerks: Lehren aus der "Handwerksnovelle" von 2004"

Ökonomenstimme - The New Web Platform for German-speaking Economists. - May 24, 2016

- Interview von Dr. Johannes Klenk (Uni Hohenheim)

Forschung hautnah: Forschungsprojekte an der University of Hohenheim. - May 2, 2016

- "Schweiz bringt Schwung in deutsche Debatte", "L’Allemagne débat aussi du revenu de base"

SWI swissinfo.ch - international service of the Swiss Broadcasting Corporation (SBC). - Mar 09, 2016

- WebTalk Bedingungsloses Grundeinkommen

Bundeszentrale für politische Bildung/bpb. - Jan 11, 2016

- "Die Menschen von der Arbeit befreien"

Der Tagesspiegel. - Dec 8, 2015

- "800 Euro für alle: Bedingungsloses Grundeinkommen in Deutschland"

DRadio Wissen. - Sept 15, 2015

- "Welche Effekte hätte ein bedingungsloses Grundeinkommen für Deutschland?"

Ökonomenstimme - The New Web Platform for German-speaking Economists. - July 8, 2015

- "Die Expertise des Internationalen Währungsfonds"

Blog of Heiner Flassbeck, a German economist and publicist. - Oct 22, 2014

- "Hoe de Europese groeimotor weer aanzwengelen"

Knack.be, a Belgian (Flemish) weekly news magazine - May 17, 2010

- Soziale Gerechtigkeit in den USA: Ein Land, das so nicht sein sollte

Süddeutsche Zeitung

GBP-Monitor: Unternehmenstrends

- Aug 2025

- 100 Tage Merz-Regierung: Außenpolitische Spannungen trüben wirtschaftlichen Aufwärtstrend

- Apr 2025

- Koalitionsvertrag und US-Zollpolitik: Ungelöster Zollkonflikt gefährdet konjunkturellen Aufschwung

- Feb 2025

- Unternehmen schätzen Wachstumsaussichten optimistisch ein und sehen eine Reform der Schuldenbremse als notwendig an.

- Jan 2025

- Nur noch 12,6 % der Unternehmen erwarten, dass die EU-Regeln zu Nachhaltigkeitsberichten tatsächlich Nachhaltigkeit fördern

- Oct 2024

- Bürokratieentlastungsgesetz IV: Lediglich 10 % der Unternehmen erwarten spürbaren Bürokratieabbau

- Jul 2024

- ESG in Lieferketten: Finanzielle Kriterien dominieren die Auswahl von Geschäftspartnern – Nachhaltigkeitsfaktoren klar untergeordnet

- Apr 2024

- Expertenbefragung: Mehrheit der Steuerforscher spricht sich für eine Reduzierung der Steuerbelastung für Unternehmen aus

- Jan 2024

- ESG: Auch wenn sich Unternehmen für Nachhaltigkeit engagieren, greifen sie nicht seltener auf Bilanzpolitik zurück

- Nov 2023

- Wachstumschancengesetz: Unternehmen sehen die geplanten investitionsfördernden Maßnahmen kritisch

- Aug 2023

- Transparenz: 30 % der Unternehmen in Deutschland wollen weniger Offenlegungsvorschriften

- Jul 2023

- Nach Corona-Pandemie: Steuerliche Erwartungen haben sich nicht bewahrheitet

- Jun 2023

- ESG: 52 % der Unternehmen in Deutschland setzen konkrete Maßnahmen in Umwelt- und Klimaschutz um

- May 2023

- Bei Erhöhung der Unternehmenssteuern: Steuerlast verteilt sich auf Arbeitgeber, Kunden und Arbeitnehmer

- Apr 2023

- Inflation: Unternehmen rechnen auch für 2024 noch mit einer Teuerungsrate von 8,1 Prozent

- Mar 2023

- Lokaler Standortwettbewerb: Funktionierende Infrastruktur ist wichtiger als niedrige Steuern

- Feb 2023

- Trotz verlängerter Abgabefrist für Grundsteuererklärungen nur kleine Fortschritte bei unternehmensinternen Prozessen

- Dec 2022

- In der Krise bleibt der Gewinn die wichtigste Kennzahl für Manager, Maße für Energieverbrauch werden immer relevanter

- Nov 2022

- Grundsteuerreform: Erst die Hälfte der Unternehmen hat geplante Digitalisierungsmaßnahmen bereits umgesetzt

- Oct 2022

- Inflation: Energieintensive Unternehmen planen Preiserhöhungen von durchschnittlich 17% in den nächsten 12 Monaten

- Sep 2022

- Immer mehr Unternehmen berichten überhöhte Gewinne, Ausfallerwartung in energieintensiven Branchen steigt auf 16%

- Aug 2022

- Corona-Hilfen laufen aus, während die Gewinne einen Tiefststand erreichen: Krisenunternehmen fordern weitere Staatshilfen

- Aug 2022

- Corona-Hilfen laufen aus, während die Gewinne einen Tiefststand erreichen: Krisenunternehmen fordern weitere Staatshilfen

- Jul 2022

- Energiekrise und Planungsunsicherheit: Bewertung der Wirtschaftspolitik sinkt auf Jahrestief

- Jun 2022

- Inflation: 86 % der Einzelhändler planen weitere Preiserhöhungen

- May 2022

- Ukraine-Krieg: Unternehmen planen Investitionen zu kürzen und Neueinstellungen zu reduzieren

- Apr 2022

- Getrübte Aussichten für Unternehmensgewinne angesichts von Kriegsfolgen und möglichem Rohstoff-Embargo

- Mar 2022

- Ukraine-Krieg: Deutsche Unternehmen unterstützen die Russland-Sanktionen trotz erheblicher finanzieller Belastung

- Feb 2022

- Staatshilfen in der Corona-Krise: Inanspruchnahme, Bedarfsdeckung und Rückzahlung

- Jan 2022

- Das politische Management der Corona-Krise und insbesondere die neue 3G-Regel am Arbeitsplatz belasten deutsche Unternehmen sehr unterschiedlich

- Dec 2021

- Die unternehmerische Lage angesichts der vierten Corona-Welle und des Regierungswechsels

- Nov 2021

- Während der Koalitionsgespräche: Wirtschaftspolitische Forderungen der Unternehmen

- Oct 2021

- Nach der Bundestagswahl: Präferierte Regierung aus Unternehmenssicht

- Sept 2021

- Trotz Aufwärtstrend sind deutsche Unternehmen mit der Wirtschaftspolitik weiterhin unzufrieden

German Business Panel Reports

- Jul 2021

- Kostenflexibilität und Krisenreaktionen von Unternehmen in Deutschland

Cost Structure Report - May 2021

- Wie Unternehmen des Baugewerbes die Corona-Krise bewerten

Construction Industry Report - Mar 2021

- Wirtschaftsbefragung vor der Landtagswahl: Unternehmen aus Baden-Württemberg und Rheinland-Pfalz kommen in der Corona-Krise vergleichsweise gut weg

Landtag Elections Report - Feb 2021

- Unternehmensgewinne gehen weiter zurück, Unzufriedenheit mit Staatshilfen steigt stark an

Firm Sentiment Report - Jan 2021

- Empirische Erkenntnisse zum zweiten Lockdown: Rückgang und Umverteilung von Unternehmensgewinnen trotz Staatshilfen

Corona Lockdown Report - Nov 2020

- Wer trägt die Last und wie wirken die staatlichen Hilfsmaßnahmen?

Corona State Support Report - Sept 2020

- Wirkung und Zielgenauigkeit der staatlichen Hilfen für Firmen in der Krise

Corona State Support Report